Electric cars are a green movement that is finally moving. Shunted to the side as the public indulged its love affair with gas-guzzling SUVs and four-wheel-drive trucks, history has finally caught up with the plug-in vehicle.

The North American International Auto Show in Detroit is the domestic auto industry’s biggest annual showcase, and the new models have traditionally been brought out in a son et lumière of dancing girls, deafening music, and dry ice smoke. The few green cars that made it this far were usually for display only — very few actually made it to showrooms.

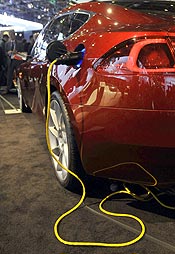

But not this year. It’s become a race to market for green cars, and soon you’ll be able to buy many of the electric vehicles that were on display last week in Detroit. The auto show featured one hybrid and battery electric car introduction after another. Although the only truly road-worthy, plug-in electric vehicle you can buy today is the $109,000 Tesla Roadster, by the end of 2010 it will be joined by such contenders as the Nissan Leaf, Coda sedan, and the Think City.

Indeed, the entire auto industry — from giants such as Ford, GM, and Renault-Nissan to startups such as Fisker Automotive — has joined the movement to build and market affordable electric vehicles.

There’s a reason the automakers in Detroit are finally plugging in as something more than a greenwashing exercise. Spurring them forward is a historic confluence of events. Chief among them are Obama administration green initiatives, including Department of Energy (DOE) loans and grants, as well as economic stimulus funds that provide $30 billion for green energy programs, tax credits for companies that invest in advanced batteries, and $2.4 billion in strategic grants to speed the adoption of new batteries. (Much of that money is going to Michigan, which despite record unemployment is emerging as something of a green jobs center.)

Other factors behind the push to manufacture electric vehicles are a federal mandate to improve fuel efficiency to an average of 35.5 miles per gallon by 2016, concerns about global warming and peak oil, and sheer technological progress building better batteries.

A key factor in making electric vehicles possible is the rapid development of lithium-ion batteries.

Even without federal largesse, some companies are moving aggressively into the electric vehicle market. A prime example: Coda Automotive, a southern California start-up, has raised an impressive $74 million in three rounds of private funding. CEO and President Kevin Czinger is a former Goldman Sachs executive, as is co-chairman Steven Heller. Among the company’s investors are Henry M. Paulson, who was Goldman Sachs’ chairman and Treasury Secretary under the second President Bush. Clearly, these former investment bankers see electric cars as a good bet.

A key factor in making today’s electric vehicles possible is the rapid development of the energy-dense lithium-ion battery. William Clay Ford Jr., the executive chairman of the company that bears his name, told me in Detroit, “Five years ago, battery development had hit a wall, and we were pushing hydrogen hard. But now so much money and brainpower has been thrown at electrification that we’re starting to see significant improvements in batteries in a way we hadn’t anticipated. Now we have the confidence that the customer can have a good experience with batteries.”

Drawing a huge crowd, Tesla Motors Chairman and CEO Elon Musk showed off his company’s 1,000th electric Roadster at the auto show. “For a little company, it’s a huge milestone,” he told me. “A year ago, we had built only 150 cars. We had two stores then, and now it’s a dozen.”

For a major automaker, 1,000 cars would not be much to show for a year, but electric vehicles are still in their infancy. And since the electric car’s first swan song in the 1920s — when the widespread availability of petroleum ushered in the era of the gasoline-powered car — very few start-up companies have reached the milestone of making green vehicles, especially battery-powered ones.

Here’s a look at some of the prime contenders bringing battery cars and plug-in hybrids to market:

- Renault-Nissan Alliance. This is the one automaker with a truly global plug-in strategy and the means to carry it out. Under the Nissan banner, the company will deploy the Leaf battery sedan, with 100-mile, all-electric range. Nissan isn’t just dumping its sleek entry into the market — it’s also building a home charger with new partner AeroVironment and partnering with local, state and federal governments — both in the U.S. and abroad — on public charging stations. In partnership with Better Place, the company will deploy a second Renault electric vehicle as part of its plan to wire up Israel with charging stations for electric cars. Renault-Nissan chief Carlos Ghosn predicts that electric vehicles could constitute 10 percent of world car sales by 2020.

- Ford Motor Company. Ford’s green strategy includes a plug-in version of the new Focus for 2011 and a “next-generation” hybrid — based on its global compact-car platform, or C-platform — in 2012. The company announced in Detroit that it would invest $450 million in Michigan as part of its electrification strategy. Michigan Governor Jennifer Granholm told me at the auto show that until recently the state “wasn’t sure it had a viable auto industry.” Today, she said, the state is enjoying $1 billion in new auto-related investment, much of it jump-started by a combination of federal funding and state tax credits.

- General Motors. GM’s big news is the Chevrolet Volt, which has definitely helped the company’s image. The Volt, which uses a small gas engine to generate electricity for its electric motor, is a lot of fun to drive if the version I drove recently in Michigan is any indication. Until now, GM has stumbled in its hybrid strategy, and it really needs this car — which will go on sale at the end of the year for a hefty $40,000 — to be a hit. But success may be more a matter of perception than actual sales. “In terms of numbers, the Volt will be pretty small for the first couple of years,” says product chief Bob Lutz. A Cadillac version of the Volt is also a possibility.

- Tesla Motors. This California start-up launched at the top of the market with its $109,000 Roadster, which combines sexy looks with supercar performance (zero to 60 in 3.9 seconds). The company is on something of a roll, having sold 10 percent of itself to Daimler for $50 million, and landed $465 million in DOE funding for its forthcoming Model S sedan — a Maserati-like, more practical version of the Roadster. Tesla’s Musk says that the company’s strategy has always been to use its sale of performance cars to finance its third vehicle, a mass-market electric vehicle. The company is currently looking at California locations for a Model S factory.

- Fisker Automotive. Perhaps Tesla’s closest competitor when it comes to glamour electric vehicles, Fisker — whose CEO is Danish-born automotive designer Henrik Fisker — is preparing to debut a high-performance plug-in hybrid (zero to 60 in 5.8 seconds, with 67 mpg fuel efficiency) known as the Karma at the end of the year. Al Gore is on the waiting list. Fisker also has a lower-cost car in the wings, called Project Nina. Fisker won $528 million from the DOE to build the Nina in a former GM factory in Delaware.

-

Coda Automotive. This start-up will deliver, in late 2010, a small battery-powered sedan with batteries from its own joint venture in China. The car is based on the Saibao, a Chinese car, but Coda has put a host of western companies to work honing an

electric drivetrain for it. “A large part of our mission is to accelerate adoption of all-electric vehicles,” Coda CEO Kevin Czinger told me. “We have put together a core group of auto and battery engineers, and are leveraging specialty automotive firms that we think can get us to the right price point.” Coda will launch with an Internet marketing strategy in California only, but it will have the capacity to produce 20,000 cars a year. - Think Global. Think is a survivor, with perhaps the longest and most colorful history among green automakers. It is a Norwegian company that attracted Ford Motor Company investment in the late 1990s with its plastic-bodied City commuter car. Ford sold the company in 2003 and it went through bankruptcy proceedings in late 2008. It has since emerged under the partial ownership of U.S. battery company Ener1, which snagged $118 million in DOE funding to expand its battery production in Indiana. Think electric vehicles will also be built there starting in 2011, in hard-hit Elkhart — once proudly known as the “RV Capital of the World” — and now suffering the effects of the recession. The two-seat Think City (with approximately 100-mile range on lithium-ion batteries) will sell for less than $20,000 in the U.S., but that price does not include the leased battery pack and includes the $7,500 federal tax credit for electric vehicles.

The list of players in the electric vehicle race goes on. Toyota is building plug-in hybrids and fuel-cell vehicles, and showed off a small cousin of the Prius in Detroit. Chrysler has an ambitious electric vehicle rollout that’s been stalled by the company’s bankruptcy and merger with Fiat. Honda continues to deploy clever hybrid cars, including the upcoming two-seat CR-Z it showed in Detroit. BMW has electrified the Mini for a test program, and has similar intentions for the Concept ActiveE, a plug-in version of the Series 1 BMW coupe. And Audi has shown sudden interest in this segment, debuting the second of its electric e-tron vehicles.

By this time next year, electric cars will no longer be just on auto show stands, but will have arrived in showrooms at last.