Earlier this month, Ontario announced it will join the carbon cap-and trade-program that Quebec and California currently participate in. That makes Ontario the fourth Canadian province to put a price on carbon. Alberta taxes its largest carbon emitters, including oil sands and power producers. And in 2008, British Columbia became the first jurisdiction in North America to adopt an economy-wide carbon tax.

Stewart Elgie, a professor of law and economics at University of Ottawa, has analyzed the results of that tax and describes them as “remarkable.” In an interview with Yale e360, Elgie, who directs the University of Ottowa’s Interdisciplinary Environment Institute, says the revenue-neutral tax has significantly reduced British Columbia’s fossil fuel use without harming its economy. “What British Columbia has done is lowered taxes on investment income and employment and increased taxes on pollution, which is exactly what we should be doing with our tax system,” he says.

Citing the lack of support for a carbon tax, both at the federal level in Canada as well as in the U.S., Elgie warns, “Pretty much every respected economic body in the world in the last few years has said we’re moving toward a global economy that will reward low-carbon, innovative, resource-efficient production. And if we don’t prepare ourselves for that, other countries are going to eat our lunch.”

Yale Environment 360: British Columbia has had a carbon tax in place on fossil fuel use and carbon emissions since 2008. It has gradually risen over time to its current $30 per metric ton, which is about 24 cents per gallon of gas. What has been the effect of that tax on fuel use and emissions in B.C.?

Stewart Elgie: What British Columbia did is more or less how an economist would design a carbon pricing system. They started with a relatively low price, $10 a ton. But then they built it up from the start by $5 a year over the next five years, so that companies and individuals knew the price was going to be going up every year.

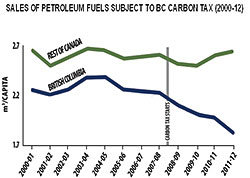

The results we’ve seen have been remarkable. B.C.’s fuel use went down by 16 percent in the first five years after the carbon tax shift. It went up by 3 percent in the rest of Canada. So B.C.’s fuel efficiency improved by 19 percent compared to the rest of Canada. B.C. has shown that putting a price on carbon really can change behavior. Our research is not detailed enough to say that all of that 16 percent was due to the carbon price, but we have done enough analysis around it to say that it looks like most of that 16 percent change was driven by the carbon tax.

e360: As opposed to the global recession and other factors?

Elgie: We’ve looked at alternative hypotheses. One is that the recession caused it, and by comparing it to other provinces that all went through the same economic recession, we know that that’s been factored out. The other explanation was that B.C. was always greener than the rest of Canada, and that’s true. So we’ve gone back to the year 2000 and found that from 2000 to 2008, B.C.’s fuel use per capita tracked pretty much consistently with the rest of Canada, whereas after 2008, it outperformed the rest of Canada by 19 percent. So it isn’t because British Columbians are just greener than the rest of us…

We looked at every type of fuel covered by the carbon tax, and in every case, B.C. significantly outperformed the rest of Canada: natural gas, home heating oil, motor gasoline, diesel oil, propane. The fact that the trend is consistent over every type of fuel really reinforces the conclusion that it was the carbon tax that drove it.

e360: And British Columbia’s economic performance in this period of time, compared to the rest of Canada?

Elgie: B.C.’s GDP has slightly outperformed the rest of Canada during that time period. Obviously the carbon price is just a small factor in the overall economy, so you couldn’t say it has helped the economy. But there is sure no evidence that it has hurt the economy, and that’s the big point.

All the revenues of the carbon tax, by law, have to go back in as income tax cuts. So B.C. now has the lowest income tax rate in Canada, for all but the highest incomers, and it had the lowest corporate tax rates up until last year, when they bumped it up, and now they are tied for second. In a sense, what B.C. has done is they’ve lowered taxes on investment income and employment and increased taxes on pollution. Which is exactly what we should be doing with our tax system.

British Columbia has ‘lowered taxes on employment and increased taxes on pollution.’

e360: So is this a painless tax? Have some industries in British Columbia been made less competitive because of it?

Elgie: Obviously any policy is going to have winners and losers. So there are two groups we worry about particularly. One is low-income households, because any type of pollution tax is essentially a consumption tax, and it will be regressive. To deal with that, B.C. has skewed its income tax cuts towards low-income households. And that’s really buffered any adverse effect on low-income households.

The second group you worry about are industries that have high greenhouse gas emissions and are exposed to export markets where their competitors may not have to pay a price on carbon. B.C. doesn’t have a heavy manufacturing jurisdiction, but it does have some. A good example is the cement industry. This tax alone, at the level it’s at, is not a major economic problem. But it is a factor on the margin for industries like cement. So B.C. has given some transitional relief to the cement industry, where they get some of their carbon tax dollars back, but it’s linked to them investing in the development of cleaner technologies. And that’s a smart policy. The mistake is to exempt those industries from your policies, because then you essentially put them on carbon welfare and you don’t want to do that. The smart approach is to give them a certain amount of transitional relief.

e360: You mentioned that British Columbia doesn’t have a lot of manufacturing. It also generates a large percentage of its electricity through hydropower. Vancouver has an OK public transportation system. Do those factors, and perhaps others, make it difficult to extrapolate out the success of B.C.’s carbon tax to other places?

Elgie: No, not at all. In fact, in some ways it’s harder in British Columbia. B.C. didn’t have what many U.S. states and other places around the world have, which are opportunities to simply phase out expensive aging coal power production plants. Because it didn’t start with that, the reductions are actually more difficult in B.C. Theirs have had to come through things like changing transportation, changing buildings, or changing home heating practices or industrial processes that use fossil fuels. Generally speaking those shifts are more costly and difficult than taking aging coal plants at the end of their life, which are already marginal in terms of competitiveness. B.C. already had a lower carbon footprint, because it was a hydropower province. So the progress that B.C. has made since the carbon tax is remarkable given that they had already decarbonized their electricity.

e360: The province of Ontario recently announced that it will join Quebec and California in a cap-and-trade system for carbon emission. But the B.C. Premier Christy Clark has said, “The carbon tax is a price signal that’s well understood by the market, compared to a cap-and-trade model that can have unpredictable effects on an economy.” Why do you think Ontario went with a cap-and-trade as opposed to a carbon tax?

Elgie: Ontario is putting a price on carbon for the same reason other jurisdictions are doing it. They realize that we are moving toward a low-carbon economy. So it’s mixed a sense of environmental responsibility and obligation — of doing our part to help solve what is probably the biggest environmental challenge facing the planet, but also an economic opportunity, recognizing that the world’s economy is increasingly going to reward companies that are energy efficient, low polluting, and eco-innovative. Creating those economic incentives now for Ontario, which has a pretty big manufacturing economy, is smart as a way of positioning the province to prosper in a low-carbon world.

‘With the carbon tax, you know exactly what you are paying, and it’s well understood by everyone.’

Premier Clark’s point is probably true, that a carbon tax creates a more visible transparent price on carbon. It will be interesting to see whether a cap-and-trade system has the same kind of overall effect. With the carbon tax, you know exactly what you are paying, and it’s well understood by everyone. That said, almost all of the research and experience in the last five years has shown that the difference between the tax and cap-and-trade doesn’t necessarily have to be very big. It has to do with how you design the system.

People often point to Europe and say that Europe’s experience with its cap-and-trade system is an example of the shortcomings of cap-and-trade. But some of the problems we’ve seen with the European cap-and-trade system have been fixed in the Western Climate Initiative system that Ontario will be joining.

e360: Canada’s environment minister recently handed down a report card to the provinces on how they were doing in terms of meeting their 2020 greenhouse gas emission reduction goals. And despite its carbon tax, British Columbia is one of the worst-performing provinces when it comes to those goals. There is currently a freeze on B.C.’s carbon tax, so how does B.C. go forward at this point? Can that carbon tax be raised to the point where the emission reduction goals are going to be met, without causing an economic downturn in the process?

Elgie: In terms of B.C., you’re right the carbon tax has been frozen since 2012. That was part of the original design, that it would ramp up predictably over a five-year period, and then they would reevaluate it. When B.C. brought in that tax, the expectation was that most of North

‘You can understand why one small province wouldn’t want to get too far out ahead of the rest of the continent.’

America would also be bringing in carbon pricing. But it simply hasn’t played out that way. So it’s understandable that B.C. has decided to pause the escalation of its carbon price to see if other jurisdictions would begin to follow suit. Obviously, from a climate perspective, it would be great if B.C. continued driving the price up. But you can understand why one small province in North America wouldn’t want to get too far out ahead of the rest of the continent in terms of putting a price on carbon emissions.

B.C. is behind its climate targets. But part of that is because B.C. has the most ambitious greenhouse gas emissions targets in Canada and, I would think, some of the most ambitious ones in North America. Yes, for B.C. to meet the targets it has set, it would need a much higher carbon price. That said, you should be careful about criticizing the place that’s done more than probably anywhere else in North America to bring in good climate policy.

e360: Canadian Prime Minister Stephen Harper remains extremely skeptical of the carbon tax. In the run-up to climate talks in Paris in December, Canada has yet to announce its post-2020 greenhouse gas reduction targets. What are your expectations in that regard?

Elgie: Canada’s performance on climate change since the [1992] ratification of [the] Kyoto [treaty] has been poor to say the least. The fact that we were the first nation to pull out of Kyoto was embarrassing, and the fact that we don’t have an economy-wide climate policy is also embarrassing. To the extent that Canada’s greenhouse gas performance has gotten better in the last seven or eight years, most of that has been driven by the provinces. It’s worth keeping in mind that in the early years of their government, back in 2008-2009, the current prime minister actually did promise to bring in a carbon pricing scheme. So the rhetoric on this has changed over time — some of this is just politics.

The idea that governments put a price on carbon simply to generate more tax revenue is empirically wrong. The British Columbia government has actually lost money to the carbon tax. They’ve given away almost a billion dollars more in tax cuts than they’ve collected in carbon tax revenue. The person who should be unhappy is B.C.’s finance minister. And the British Columbia Taxpayers Federation should be thrilled, because B.C.’s shift has actually benefited taxpayers on the whole.

e360: Former U.S. congressman Bob Inglis, a Republican from South Carolina, was just named the 2015 recipient of the John F. Kennedy Profile in Courage Award for the political courage he demonstrated by declaring he believed in climate change and that measures should be taken to mitigate it. Inglis supports a carbon tax. When a Republican takes that stand and it merits a prestigious award, what does that tell you?

Elgie: Pollution pricing should not be a left-right issue. If you look at European countries, there are many conservative prime ministers that are fully supportive of carbon pricing. In North American and Australia, we still have remnants of short-sighted conservativism that either question the legitimacy of climate change or the need for any serious policy to address the problem. It’s becoming less and less politically acceptable, at least in this country, for political leaders to question climate change. So instead they say, “Well, I believe in climate change, but the cost of addressing it will be crippling so we can’t do anything about it.” And of course all of the evidence, including from B.C., is the opposite.

ALSO FROM YALE e360Can Green Bonds Bankroll A Clean Energy Revolution?

Ultimately, for this issue to succeed, it’s got to stop being a political football. Making serious progress on moving toward a low-carbon economy is going to require a consistent period of policy stability that will have to endure across governments. It cannot be something that gets done by one government and undone by the next. If you look back at U.S. history on clean energy, in the Carter years, the U.S. was actually a world leader in clean energy technology. In the Reagan years, they canceled those investments and actually took down some of the pilot projects. And all of that learning moved largely to Europe and Japan. And those countries took it, refined it, and then sold it back to the U.S. twenty years later.

That experience ought to show the U.S. the dangers of thinking about clean economy investments through a short-term political lens. The fastest parts of the world’s economy are in resource efficiency, clean energy, low-emission transportation. Pretty much every respected economic body in the world in the last few years has said we’re moving toward a global economy that will reward low carbon, innovative, resource-efficient production. And if we don’t prepare ourselves for that, other countries are going to eat our lunch.