A liquefied natural gas import terminal near Porto Levante, Italy. MARCO SABADIN / AFP VIA GETTY IMAGES

As part of its efforts to wean itself off Russian energy, Europe has sought to import more natural gas from overseas, erecting new terminals for processing deliveries of liquefied natural gas. But this new capacity is set to far exceed demand, an analysis finds.

With war roiling energy markets, Europe has aimed to swap gas delivered by Russian pipeline for liquefied natural gas (LNG) delivered by ship, largely from the U.S. and Qatar. From the beginning of last year, Europe has added six new LNG terminals, expanded an existing terminal, and restored a dormant terminal.

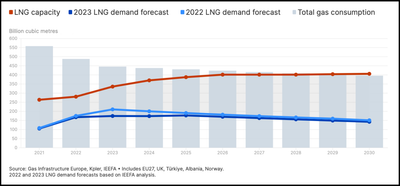

But much of that new infrastructure may prove unnecessary as European gas consumption declines, according to the Institute for Energy Economics and Financial Analysis. Europe’s recent efforts to build out renewables and curb gas consumption are paying off. After a surge in imported LNG in 2022, it has seen imports flatten out this year.

With new LNG infrastructure still coming online, the analysis found, Europe will be able to import 406 billion cubic meters of natural gas by 2030, slightly more than the 400 billion cubic meters of natural gas it is projected to consume in total.

“The decline in gas demand is challenging the narrative that Europe needs more LNG infrastructure to reach its energy security goals,” said analyst Ana Maria Jaller-Makarewicz. “The data is showing that we don’t.”

Experts have warned that new LNG infrastructure could incentivize future consumption of natural gas even as countries must cut fossil fuel use to avert dangerous climate change. A new report from the International Energy Agency finds that the global buildout of LNG infrastructure threatens to create a supply glut, which could cause prices to crater later this decade.

ALSO ON YALE E360

Averting Crisis, Europe Learns to Live Without Russian Energy