Tiny Columbus, New Mexico (population, 1,678) is hot, flat and uncrowded — an ideal place to launch a new green revolution in agriculture. That, in essence, is what a well-funded startup company called Sapphire Energy wants to do: It is turning a 300-acre expanse of desert scrub into the world’s largest algae farm designed to produce crude oil. Sapphire began making oil there in May, and its goal is to produce about 100 barrels a day, or 1.5 million gallons a year, of oil, once construction of the “green crude farm” is completed next year.

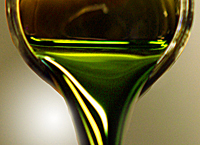

“We take algae, CO2, water and sunlight, and then we refine it,” says Cynthia Warner, the chief executive of Sapphire, who joined the company after working for more than 20 years at oil-company giants Amoco and BP. Algae, she says, has the potential to change the world, by reducing carbon dioxide emissions and enabling almost any country to make its own oil. “This technology is so compelling — and it will make such a big difference — that, once it gets out of the gate, it will ramp up very quickly,” Warner says.

Scientists have been trying to unlock the energy potential of algae for decades, but they don’t yet agree on how to go about it.

Sapphire is one of scores of companies worldwide that today are making biofuels from microalgae, albeit on a small scale, according to the Algae Biomass Organization, a trade group. Solazyme, which is arguably the industry leader, last year sold an algae-derived jet fuel to United Airlines, which used it to fly a Boeing 737-800 from Houston to Chicago — the firsttime a commercial jet flew using a biofuel made using algae. Synthetic Genomics, a company founded by geneticist J. Craig Venter and financed by ExxonMobil, is building an algae farm in the Imperial Valley of southern California. Other algae farms are under development in Hawaii, by Phycal, and in Karratha, Australia, by Aurora Algae, and in Florida, by Algenol. In Europe, the Swedish energy company Vattenfall and Italy’s Enel Group have been using algae, which is then made into fuel or food, to absorb greenhouse gas emissions from power plants, and Algae-Tec, an Australia-based company, has agreed to operate an algae-based biofuel plant in Europe to supply Lufthansa with jet fuel.

Although scientists and entrepreneurs have been trying to unlock the energy potential of algae for more than three decades, they don’t yet agree on how to go about it. Some companies grow algae in ponds, others grow them in clear plastic containers, and others keep their algae away from sunlight, feeding them sugars instead. To improve the productivity of the algae, some scientists use conventional breeding and others turn to genetic engineering. “Algae is the most promising source of renewable transportation fuel that we have today,” says Steve Kay, a distinguished professor of biology at the University of California, San Diego, and co-founder of the San Diego Center for Algae Biotechnology, a partnership of research institutions, business, and government.

And yet there’s plenty of reason for skepticism about algae. Scientists and entrepreneurs have been trying for decades to unlock algae’s energy potential, with mixed results. After the 1970s oil shocks, the U.S. government created an algae research program that analyzed more than 3,000 strains of the tiny organisms; the program was shut down in 1996, after the Department of Energy concluded that algal biofuels would cost too much money to compete with fossil fuels. A decade later, after President George W. Bush declared that the U.S. is “addicted to oil,” government research into algae was restarted, and venture capital flowed into dozens of algae startups. Oil companies ExxonMobil and Chevron placed bets, too.

But algae companies haven’t made much oil yet: Sapphire’s annual production target of 1.5 million gallons for 2014 compares to U.S. daily oil consumption of 18.8 million barrels. Even algae’s most enthusiastic advocates say that commercialization of algal biofuels, on a scale that that would matter to the environment or the energy industry, is at least five to 10 years away.

Government researchers maintain that the environmental benefits of algae remain unproven.

High costs remain the big obstacle to commercial production. The algae business has suffered from “fantastic promotions, bizarre cultivation systems, and absurd productivity projections.” says John Benemann, an industry consultant and Ph.D. biochemist who has spent more than 30 years working on algae. Even if the capital costs and operating costs of algae farms are low, and the productivity of the algae is improved, Benemann says that “algae biofuels cannot compete with fossil energy based on simple economics”¦ The real issue is that an oil field will deplete eventually, while an algae pond would be sustainable indefinitely.” In a thorough 2010 technology assessment, researchers at the Lawrence Berkeley National Laboratory estimated that producing oil from algae grown in ponds at scale would cost between $240 and $332 a barrel, far higher than current petroleum prices.

Perhaps more worrisome, government scientists say the environmental benefits of algae remain unproven. Writing in American Scientist, Philip T. Pienkos, Lieve Laurens and Andy Aden, all of the National Renewable Energy Laboratory, say that the few life-cycle assesements of algae done so far have shown “unpromising energy returns and weak greenhouse gas benefits.” By phone, Pienkos acknowledged that, in theory, algae should produce low-carbon fuels because the CO2 emitted when the fuels are burned is absorbed from the air when algae grow. But, he says, calculating the true sustainability benefits of algae requires doing a detailed study of inputs and outputs and “that will be difficult until big algae farms are built.”

So why continue to pursue the algae dream? Because algae, even skeptics say, are remarkable little creatures that could someday realize their potential as energy producers. Algae are easy to grow, as any owner of a background swimming pool knows (and as does the U.S. National Park Service, which this month began draining the Lincoln Memorial reflecting pool to remove a sea of green). Algae grow rapidly, reaching maturity in days. They absorb carbon dioxide, a greenhouse gas. They thrive in fresh, saline or brackish water. And they don’t compete with food crops for land. According to the National Renewable Energy Laboratory, algae yield more lipids, or oil, than other biomass feedstock — as much as 30 times more per unit of land when compared to terrestrial oilseed crops like palm and soy.

What’s needed now are concentrated efforts to deploy all the tools of modern agriculture to bring down the costs of growing algae, harvesting the crop, and extracting its oil. That’s the focus of all the algae startups. In New Mexico, for example, Sapphire is trying to drive extraneous costs out of its ponds (do they need plastic liners, or will dirt do?), out of the process of removing algae and returning water to the ponds, and out of the thermo-chemical process used to separate oil from the algae. “Each step requires multi-disciplinary, multi-year R&D,” Warner says.

Companies are using conventional breeding and genetic modification to develop strains of algae to grow faster, yield more oil, and repel pests.

None of this comes cheap: Sapphire has raised $300 million from investors including venture capitalists Arch Venture Partners and Venrock, British charity The Wellcome Trust, and Cascade Investment, which manages the personal fortune of Bill Gates. The U.S. Department of Energy awarded Sapphire a $50 million grant in 2009, and the company has secured a $54.4 million loan guarantee from the U.S. Department of Agriculture.

Solazyme experimented with open-pond technology in the late 2000s before deciding to abandon the sun (though it kept the “sola” in its name). The company now grows its algae indoors, in big industrial fermenters in a factory in Peoria, Ill., and feeds them biomass such as sugarcane or corn stover. In an email interview, Solzayme’s CEO, Jonathan Wolfson, said, “The economics for producing oil via open ponds was simply not viable in a time frame that would work for our commercialization plans. While algae is a prolific oil producer, it is far from the most economic way to convert carbon dioxide and sunlight into sugars, which is the first step in making oils.”

By engineering its algae to perform whatever task is at hand, Solazyme says it has developed for the first time in history “the ability to design oil rather than simply use what’s available in nature.” The company makes not just transportation fuels, but oils for food products including cakes, cookies and ice cream; personal care products like soaps and detergents; and chemical products like lubricants and surfactants. Serving a variety of markets enabled Solazyme to attract investment from the likes of Chevron, British entrepreneur Richard Branson, and Unilever, and to generate enough revenue so the company could go public last year. (Its current market value is about $650 million.) More important, Solazyme plans to grow its production capacity faster than its rivals — it says it will produce about 142 million gallons a year of renewable oil by 2015.

By far the biggest opportunity to reduce the costs of algal fuels lies within the algae. Just as crop scientists have bred corn and wheat to improve yields, with spectacular results, the algae companies are using conventional breeding and genetic modification to develop strains of algae to grow faster, yield more oil, and repel pests.

Venter’s Synthetic Genomics is going a step further, studying natural algae in order to design, from scratch, a plant of its own. Venter was not available for an interview but he told Scientific American last year: “Everybody is looking for a naturally occurring algae that is going to be a miracle cell to save the world and, after a century of looking, people still haven’t found it. We hope we’re different.” Venter noted that genetic tools “give us a new approach: being able to rewrite the genetic code and get cells to do what we want them to do.”

For now, Synthetic Genomes is growing algae in a greenhouse in La Jolla, Calif. The company recently acquired 81 acres of land in the California desert, near a power plant that is expected to be a source of cheap CO2. Like the other algae companies, Venter’s venture is well financed. ExxonMobil has promised the company $300 million over the next decade, provided that its research and development milestones are met; other backers include BP and venture capital firm Draper Fisher Jurvetson.

Venter admits that success is by no means guaranteed, and that patience will be required to see the benefits of algae. Algae plants may grow in days, but a real algae industry will need years, if not decades, to reach maturity.

Correction, October 15, 2012: An earlier version of this article incorrectly stated U.S. daily oil consumption. The correct figure is 18.8 million barrels.