Pulling CO2 straight from the air is expensive, but it can be done nearly anywhere, with easily quantifiable results.

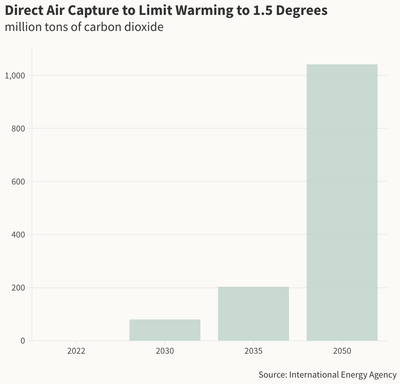

Those incentives are important given the second major issue: scale. The plants in operation today together capture just 10,000 metric tons of CO2 a year. The largest of these — a project called Orca, run in Iceland by Climeworks — soaks up 4,000 metric tons per year. But the International Energy Agency’s (IEA) pathway to net zero by 2050 calls for pulling 80 million metric tons of CO2 from the air annually by 2030, and more than a billion metric tons by 2050. That will involve a herculean effort, requiring tens of megaton-scale plants to be built per year. Stratos would be just the first.

“It’s technologically feasible,” says World Resources Institute analyst Katie Lebling, who dug into the topic in a 2022 working paper. But, she adds, “are all the policies ready? Is the financing there? Are people supportive?”

The struggle to hit net zero emissions by 2050 is real. While the world ramps up installations of wind and solar to replace the burning of fossil fuels, the Intergovernmental Panel on Climate Change (IPCC) concludes that carbon dioxide removal, while not a substitute for deep emissions reductions, “is part of all modelled scenarios that limit global warming to 2 degrees Celsius or lower by 2100.”

A rendering of the Stratos direct air capture plant now being built by 1PointFive in Texas. 1PointFive

There are plenty of ways to remove carbon from the air, each with pros and cons. Planting and protecting forests and other ecosystems — called nature-based solutions — is relatively cheap, can be done at large scale, and has a heap of side benefits, including the provision of habitat for endangered species, flood protection, or increased food supplies for humans. The IPCC’s 2018 Special Report on Global Warming of 1.5°C calculated that up to 11 billion metric tons of CO2 could be drawn down in this manner per year by 2050, a huge chunk of today’s roughly 35 billion metric tons in emissions. But the amount of carbon stored by nature can be hard to estimate and uncertain: A wildfire can wipe out a forest, for example.

According to the IEA, capturing CO2 directly from the flue stacks of power plants and other industrial operations, like concrete plants, which are hard-to-mitigate sectors, should be used to soak up nearly 4 billion metric tons of CO2 a year by 2050. But these methods don’t touch legacy CO2, which is more dilute in the atmosphere. Pulling CO2 straight from the air is expensive, but it can be done nearly anywhere, with easily quantifiable results. The IEA target of roughly 1 billion metric tons by 2050 is a smaller but still substantial slice of the pie.

Once CO2 is captured, companies need to decide what to do with it: bury it or use it to make a product.

Today, there are two main strategies for air capture, each of which involves large fans that pull air into a processing area. The first strategy absorbs CO2 onto a solid filter; then a combination of low pressure and moderate temperatures (around 90 degrees C) pulls the concentrated CO2 back out. This process has a relatively high energy requirement, but the biggest plant currently using it — Climework’s Orca — makes use of geothermal energy. The capture units — Orca’s resemble industrial air conditioners the size of a shipping container — are typically modular, so a capture facility can host just a handful of these units, or many, and be placed basically anywhere there’s ready access to renewable energy.

The second strategy absorbs CO2 into a liquid, transfers the CO2 to limestone pellets, and uses very high temperatures (about 600 degrees C) — typically supplied by a fossil-fuel-powered furnace — to remove the CO2 and recover the reagents. The CO2 released from the furnace can be captured too. This system requires a lot of water. But the chemical process is well suited to very large operations. This technique, as developed by the British Columbia-based company Carbon Engineering, is powering Stratos.

Other options are available. The California-based company Heirloom, which opened the first commercial air capture plant in the U.S. last November, with a capacity of 1,000 metric tons a year, uses a variant on the limestone technology. The company simply exposes trays of powdered calcium oxide to air to soak up CO2 and turn it into limestone. Like the other limestone technique, the Heirloom process also releases CO2 from the limestone using high temperatures, but this facility uses renewable energy to do so.

The International Energy Agency’s pathway to net zero by 2050 calls for dramatically scaling up direct air capture. Yale Environment 360

All of this is costly. Businesses can currently buy carbon credits online from Climeworks at the startling price of $1,500 per metric ton. That’s extremely expensive; other voluntary carbon credits — from schemes that plant trees or make industry more efficient and less polluting, for example — can be purchased for tens of dollars per metric ton. But these credits are still attractive because they are easily quantifiable, verifiable, and durable over long time periods. Microsoft announced in 2022 that it bought 10,000 metric tons of credits from Climeworks in a 10-year deal, though it did not disclose the price. 1PointFive has deals in place to sell credits to Amazon, Airbus, and other companies once it’s up and running.

Of course, the commercial selling price of carbon credits isn’t the same as the company’s cost of capture. That is surely lower, but numbers are hard to pin down; Climeworks won’t disclose specifics but says $1,000 per metric ton is in the ballpark. The IEA estimates that the operational costs of direct air capture should get to between $230 and $630 per metric ton of CO2 once scaled up, depending in large part on energy costs, says Mathilde Fajardy, an IEA analyst. Others are less optimistic. According to Howard Herzog, of MIT’s Energy Initiative, a reasonable estimate for the cost of direct air capture by 2030 is between $600 and $1,000 per metric ton of CO2. “Most estimates out there are unrealistic,” he says.

About three-quarters of globally captured C02 is currently being used for enhanced oil recovery, which is controversial.

To tackle both cost and energy use, the DOE’s Carbon Negative Shot program, launched in 2021, ambitiously aims to get the cost of direct air capture below $100 per metric ton by sponsoring technology innovation. That price would make air capture profitable against, for example, a U.S. tax credit that, as of 2022, offers $180 per metric ton for large-scale stored CO2.

Last December, the DOE put up more than $1 million in prize money for promising direct air capture technologies. There are seven semi-finalists. Elysia Labs, in Phoenix, for example, is developing a nanofiber-based sorbent that needs less of a pressure drop and thus requires less energy to pull CO2 from the air. And Nūxsen, in New York City, is developing an electrochemical cell that it says can capture and release CO2 without energy-intensive heat or pressure changes; the company plans to use small modular nuclear reactors to power its system.

Meanwhile, some researchers are using artificial intelligence to accelerate innovation. Meta — the company behind Facebook and Instagram — is working with Georgia Tech on the OpenDAC project to help find better porous polymers to efficiently soak up and release CO2. Whether any of this proves useful at an industrial scale remains to be seen.

The Carbon Engineering direct air capture pilot plant in Squamish, Canada. James MacDonald / Bloomberg via Getty Images

Yet once CO2 is captured, companies need to decide what to do with it. The most carbon-negative option is to bury it deep underground. This is what Climeworks does in Iceland, for example, and plans to do with its upgraded facility, called Mammoth, due to launch this year. There are plenty of suitable geological repositories for buried CO2. But for now, this strategy is in the minority: the IEA reports that as of 2022, out of 18 plants operating globally, only two — both run by Climeworks in Iceland — bury their CO2.

The other option is to use captured CO2 to make a product — like fertilizer, for example — or use it to carbonize beverages or as an ingredient in other industrial chemicals. This is what the majority of direct air capture plants do today. Heirloom, for example, works with a partner company to use its captured CO2 in making concrete. The biggest potential future market could be synthetic fuels for airplanes, wherein captured CO2 is combined with green hydrogen (made by splitting water with renewable electricity) to make synthetic hydrocarbons. The Norsk e-fuel project in Norway, the Haru Oni efuels plant in Chile, the AtmosFUEL project in the U.K., and Carbon Engineering, in Canada, are among companies pursuing this end use. In the IEA’s pathway to net zero, about 35 percent of air-captured CO2 gets used for synthetic fuels by 2050, while the rest is buried.

The energy it takes to power capture, says one critic, would be better spent replacing fossil-fuel-based electricity.

For now, though, about three-quarters of all globally captured CO2 (which comes mainly from industrial flue stacks) is currently being used for enhanced oil recovery, says Fajardy. The CO2 gets injected into oil wells to both bury it and to help push out more oil. This is controversial, as many note that it doesn’t disincentivize fossil fuels. “Enhanced oil recovery has been a stepping stone for early carbon capture and storage projects to help with the economics,” says Herzog. “If your primary goal is negative emissions, it is not a good fit.” But supporters point out that it’s still burying CO2: If done carefully, they claim, then even after burning the recovered oil the process can come out as a net zero or even a net negative equation for carbon, though that’s hard to quantify.

What will happen to Stratos’ CO2 hasn’t yet been decided. The plant’s location in Texas, and the fact that the companies building it, 1PointFive and Carbon Engineering, are both owned by Occidental Petroleum, has led some to speculate that this project will be used for enhanced oil recovery. Kel Coulson, Carbon Engineering’s director of policy, says Stratos has several options for its CO2, including burying it in saline reservoirs or producing low-carbon products, which they call “net-zero oil.” “The ultimate use of captured CO2 from Stratos will be driven by customer preference,” Coulson says.

The Orca direct air capture and storage plant, operated by Climeworks, in Hellisheidi, Iceland. Arnaldur Halldorsson / Bloomberg via Getty Images

The economic and environmental hurdles leave some concluding that air capture is not a good idea at all. Mark Jacobson, director of the Atmosphere/Energy program at Stanford University, has long been a detractor: The energy it takes to power capture, he says, would be far better spent replacing fossil-fuel-based electricity for decades to come. “There is never a case where direct air capture or carbon capture is useful,” Jacobson says.

Despite such criticism, the industry is moving forward. Last August, the DOE selected two megaton-scale projects for funding: another 1PointFive venture in Kleberg County, Texas, and an effort in Louisiana called Project Cypress, which has announced it will not participate in enhanced oil recovery. Two more hubs will follow from the DOE. And a handful of other megaton-scale efforts are planned elsewhere, including a Carbon Engineering effort in the United Arab Emirates and Project Bison in Wyoming, which is aiming to capture an ambitious 5 megatons a year by 2030.

If all 100-plus projects on the drawing board go ahead as planned, they’ll capture around 70 metric megatons of CO2 by 2030, says the IEA. That’s very close to their 80 metric megaton target. But it’s also a very big if.